Do markets signal a manageable winter heating season in Europe?

Markets have a way of softening, if not entirely mitigating, the blows of bad policy.

Very short note.

Over the last week-and-a-half I’ve been seeing or hearing a lot of this:

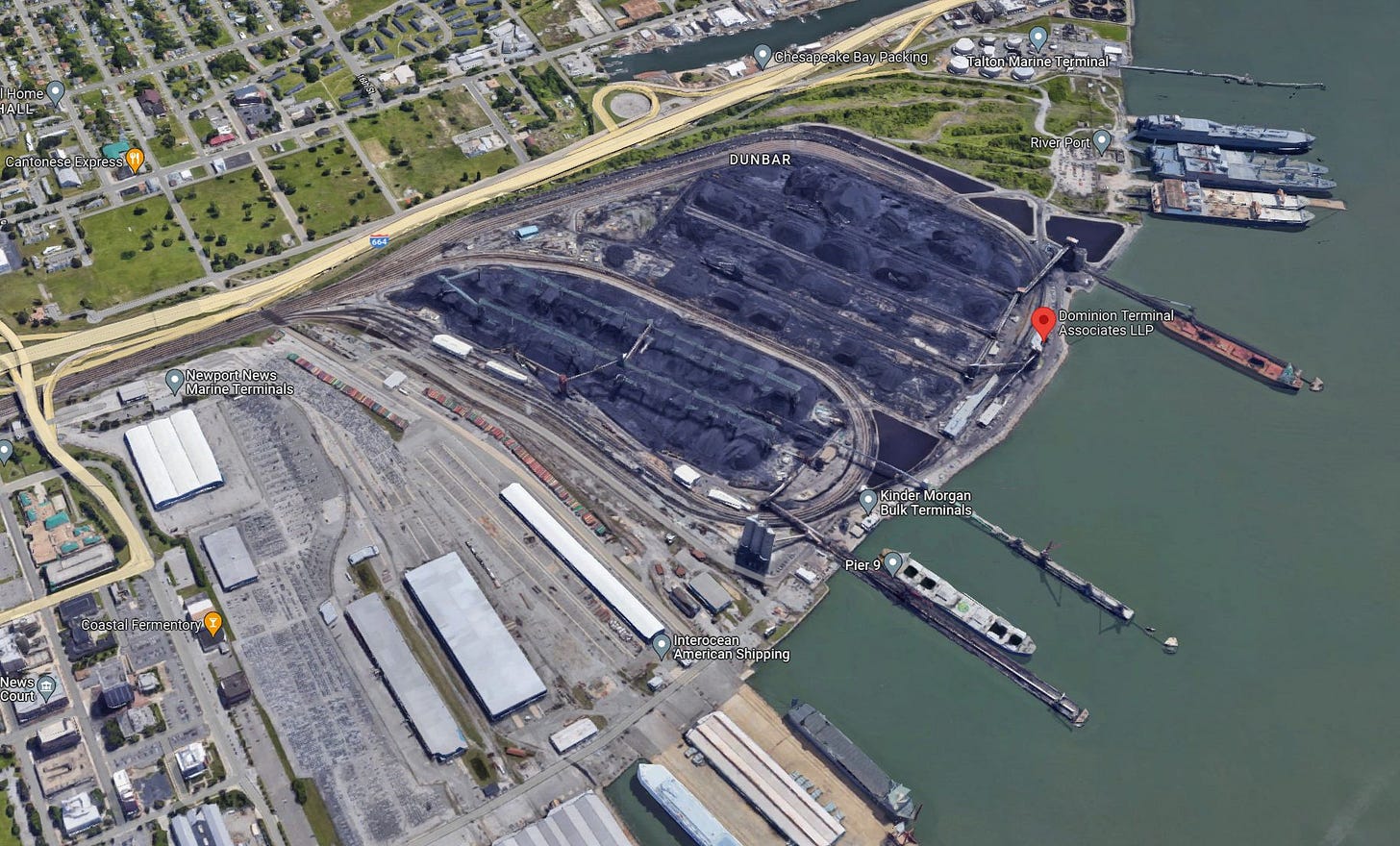

On the suspended railroad trestle, one can see a segment of a mile-long train of open cars brimming with coal. That coal is bound for the export terminal at Newport News, Virginia:

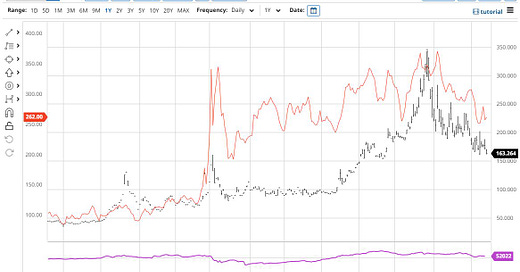

And here’s what markets for coal and natural gas in Europe look like over the last year:

The red line indicates coal prices (Rotterdam futures prices), and the black line indicates gas prices (Dutch futures prices). Both remain elevated by the standards of the last 20 years, but prices have been moderating. So, it looks like it will be an expensive heating season in Europe, but have suppliers not already situated Europe to muddle through?

I ask, because one of the political memes out there is that “Europe is going to freeze to death this winter.” That is not to say that policymakers have not willfully manufactured an energy crisis all the while resorting to the all-purpose excuse of “Putin,” but markets have this way of enabling the market players who are still standing to make important adaptations and soften the blows of destructive policy.