Short note.

I myself knew nothing of the ersatz “crypto exchange” FTX and its CEO SBF (Sam Bankman-Fried) until last week.

To recount: SBF was ostensibly worth tens of $billions last week. The next day he was worth virtually zero. WTFSECMIA?

Headlines about the collapse of FTX/SBF immediately segued into headlines about the collapse of “crypto” as a whole. Phrases like “Ponzi scheme” abound.

SBF meanwhile, had presented himself as a great philanthropist and as one of the largest contributors to Democratic Party political campaigns. The objects of his philanthropy—to the extent there was any philanthropy—amounted to funding the usual items on the usual menu of items like Climate Change™ and newer items like measures to “prevent the next pandemic,” because vaccine mandates macht frei, obviously.

I do not have any insights into what FTX was up to—here is a nice piece over at Tablet—but let me relate two ideas:

What “Ponzi scheme?” It is not obvious that the FTX episode reveals anything about the integrity of the cryptocurrency concept.

“Effective Altruism” really does align with what SBF identified in an interview with Vox as “this dumb game we woke westerners play where we say all the right shibboleths and so everyone likes us.”

On the first point. I am not really up on the crypto phenomenon, but I understand that Bitcoin, the most prominent cryptocurrency, is designed so that no party can reproduce it. That’s its main feature. No government, no individual, no entity can just electronically print new Bitcoins. So, if Bitcoin were to be widely accepted as a medium of exchange, it would amount to a “hard currency.” In contrast, we currently operate with “fiat currencies.” If governments find themselves short of cash they can, and often have, electronically print money. For example, the US Treasury Department may sell $1 trillion in bonds. The Federal Reserve can buy those bonds. The Treasury thus finds itself with a trillion new dollars. The Fed updates a spreadsheet; by key stroke it now owns $1 trillion in new bonds. The Treasury pays the Fed interest on those bonds.

This is the stuff of “quantitative easing.” Now, do it five times over; let the Fed buy $5 trillion in bonds over the course of the last two years. There are now 5 trillion in new dollars floating around the economy. Worse, that money first gets in the hands of the federal government, and it uses that new money to fund whatever projects it wants. War in Ukraine? No problem. Bailouts for politically favored factions? No problem. Gender studies in traditional societies? Easy. Subsidies to favored corporate interests? Crony Capitalism is great when it’s your cronies who get the money.

It gets worse. That $5 trillion ultimately translates into inflation. Why? Because the federal government effectively gave itself $5 trillion in new claims on value in the economy. But, printing money does not, itself, create value. The same amount of value is out there, but the government has merely arrogated to itself by fiat a greater claim on that value. Increasing the share of its claims on real value amounts to diminishing everyone else’s claims. That diminution manifests itself as inflation. “You’re welcome,” the federal government tells us. “It’s all for good causes of our arbitrary choosing.” It’s all going to suck.

I elaborated on these mechanisms of suckiness in a piece titled “Inflation, Deflation and Les Miserables.”

The bit about if Bitcoin were to become widely accepted as a medium may amount to a big if, but is it implausible? Consider historical examples of other media that various societies had adopted as media of exchange: beads, shells, silver, massive stone wheels (on Yap Island) … gold. Do any of these media have intrinsic value? People have used gold and silver for ornamentation. There’s some modest value in that. Gold and silver conduct electricity well. One could craft electronic circuits out of them. But, other than that, what intrinsic value do they have? Not much really, but the history demonstrates that intrinsic value is not what makes for an effective medium of exchange. The extent to which these items have been hard to reproduce has made them effective media of exchange.

In an earlier piece, I laid out an example of the consequences of “printing money.” I discussed the fact that the influx of gold from the Americas in the 16th century induced much inflation in the Mediterranean economy. That inflation increased the buying power of the Spanish Empire, but the Ottoman Empire ended up paying much of the cost, because it found itself with reduced buying power. The influx benefited the Spanish, because it was the Spanish who were flooding the Mediterranean economy with gold. Everyone may have experienced inflation, but the party doing the inflating (Spain) ended up with greater claims on the value out there in that economy.

So, again, does the FTX/SBF episode really tell us anything about the viability of cryptocurrency concept? Not really. Meanwhile, we all know that governments around the world are themselves getting into the crypto business. They are experimenting with “Central Bank Digital Currencies” (CBDC’s). CBDC’s may, unlike Bitcoin, be designed to be seamlessly reproduced. If the government needs more money, it could just issue more CBDC. The rest of us would pay for that through inflation. On top of that, the government could selectively destroy money at the push of a button. If the central authorities don’t like what you’re doing—maybe they don’t like you participating in Canadian trucker protests—then they can make your money disappear. Alas, CBDC’s macht frei.

If there is a Ponzi scheme to worry about, it will be run by your government, and all of us will be situated at the bottom of the pyramid. This is also going to suck.

About effective altruism. Last week I posted a piece titled “We Can Feed the World!” about how the hubris of technocrats leads them discover centralized solutions to problems that don’t exist. Worse, their solutions may end up creating problems—or at least much waste—where there had been no problems. This SBF business amounts to a timely follow-up.

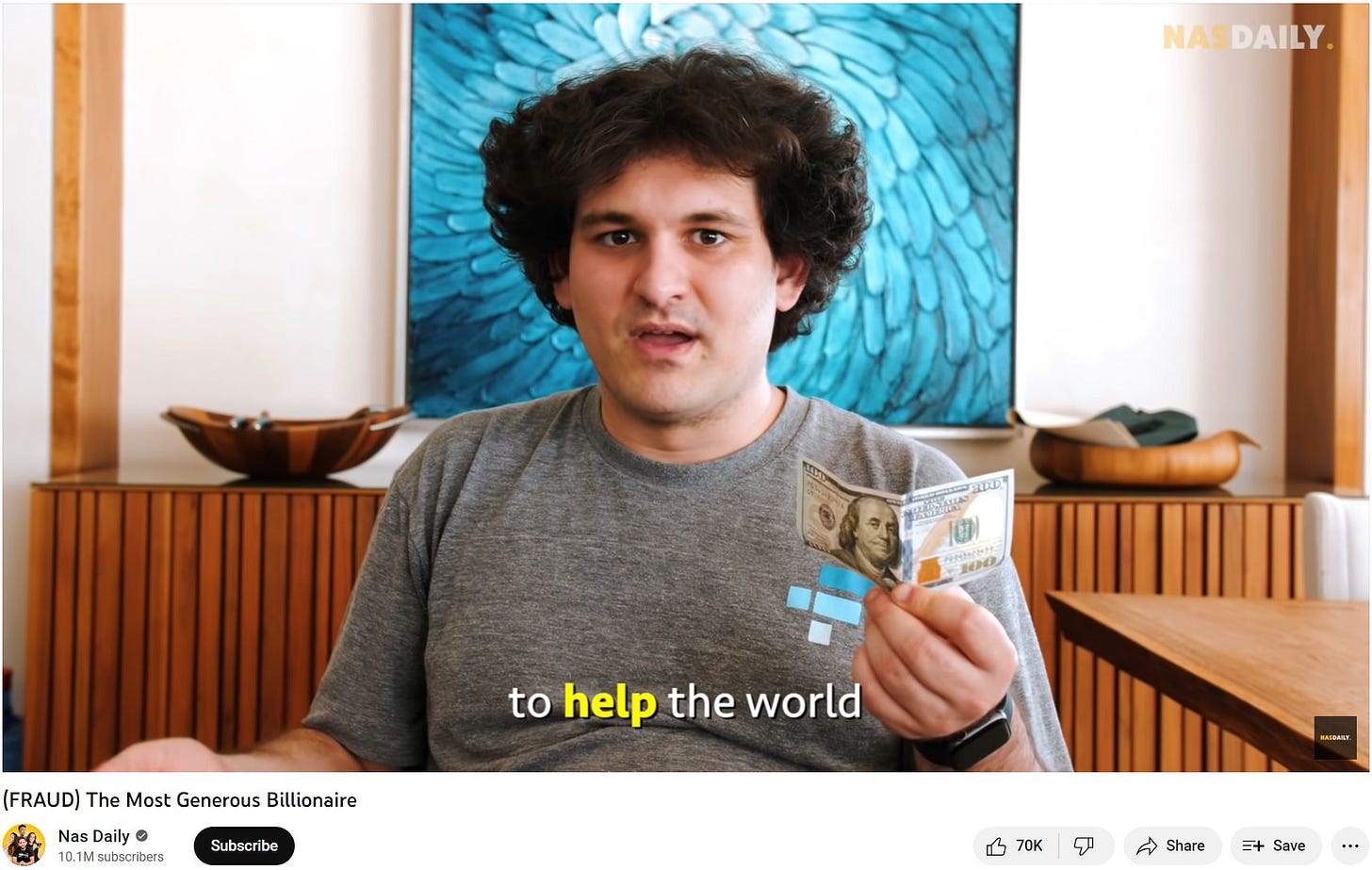

SBF’s incipient career in effective altruism seems to fit the bill. He put out some blather about Climate Change and vaccines and animal welfare, but, in an interview with Vox, he dismissed all of that as just marketing for himself. Hence that business about “this dumb game we woke westerners play where we say all the right shibboleths and so everyone likes us.” It was all just blitz and glitz.

Here is a vivid example of the hype: “The Most Generous Billionaire” or Chief Eunuch?

It doesn't invalidate your point but this:

"No government, no individual, no entity can just electronically print new Bitcoins"

Isn't quite right, you can mine new coins, it just takes significant effort/luck.

Either way it is the rarity that matters as you explain. The lesson from FTX doesn't seem to be specific to crypto in the same way the failure of a single bank doesn't tell you much about banking as a whole, or the crash of a particular stock tell you about stock markets as whole.

Rather it is something true of any financial product, that some are better than others, there will always be people hiding things or trying to rip you off, and their will always be exuberance that pushes values of some products way above their fundamentals and results in a crash.

You are exactly right that the deeper suspicion should always be of governments, and the plans for CBDCs are very alarming.

If the current FTX manager is correct in saying the books were abysmal, we can expect to see our benefactor to politics, SBF might be headed to jail. The greater fools had no idea they were not investing in much of anything other then hype around a brilliant, corrupt new millionaire boy wonder. I am stunned that a teachers retirement fund placed bets on FTX. Apparently SBF in a moment of insanity took on Binance where it's astute manager smelled trouble and cashed out exposing the scheme.

I just wonder how much real money has been trashed along the way to easy riches created by financial engineering.