Short note. I was not going to post anything today, but this target just presented itself. It’s too big, too easy and too stupid to just let slip by:

Russia Confounds the West by Recapturing Its Oil Riches

Thus blares a piece from the Wall Street Journal (provided to us for free by the Bangkok Post).

Moscow is raking in more revenue than ever with the help of new buyers, new traders and the world's seemingly insatiable demand for crude.

“Insatiable demand?” Call it evidence of markets healing in the face of efforts by the NATO bloc to shut them down.

Russia pumps almost as much oil into the global market as it did before its invasion of Ukraine. With oil prices up, Moscow is also making more money.

The bit about oil prices being “up” may not have been entirely obvious, but the bit about Russia selling almost as much oil now as pre-invasion was predictable and was predicted. It was even predicted here back in March just after the invasion:

Various parties talk about giving up importing oil from Russia. The idea, presumably, is that giving up on Russian oil will disrupt an important source of export revenue for Russia. Russia might find continuing its war with Ukraine financially untenable.

All well and good, except that it’s not obvious that the determination of some cluster of countries to stop buying Russian oil will have much effect on Russian oil revenues. Getting all countries in the world to boycott Russian oil would be one thing. A global boycott would deny Russia revenues from exports. But a partial embargo might amount to little more than political theater. One country stops buying oil from Russia; it turns around and starts buying more oil from alternative sources like Nigeria or Ghana. Other buyers find themselves buying less from these other sources… and buying more Russian oil. So, imposing artificial constraints on the sourcing of oil induces a reshuffling of the market-wide sourcing of oil. The main effect, ultimately, of very partial embargoes is to induce marginally higher costs in the delivered cost of oil. Presumably, buyers were working hard to procure oil at least delivered-cost pre-embargo. Imposing [a boycott] amounts to forcing themselves to procure oil from sources that can yield second-to-least delivered cost. The entire global logistics network ends up operating at slightly higher cost, but it is not obvious that, but for some hiccups in making adjustments, the effects on “the price of oil” are more than second-order. If even that. So, says the Naïve Economist.

The Naïve Economist was just getting started:

[L]et’s consider what the Naïve Economist might have to say about logistics and globalized markets more generally. First, we have this idea of “energy independence.” If, say, the United States procures no oil from other countries, then it has achieved an important degree of energy independence. But, get this: Suppose OPEC or Russia were to reduce oil production. What would happen to prices in global oil markets? They would go up. Even the prices paid by American buyers would go up. So, if prices paid domestically are affected by production decisions made half-a-world away involving oil that domestic buyers were not going to buy, anyway, then is the country actually “independent”? (Answer: No.) Global supply goes down; global price goes up.

Second: Global markets are not global for no reason. They’re global, because people invested real resources in logistical networks, the stuff that gets commodities at least-cost from producers to buyers. That’s not something to be taken for granted. Logistical networks can be destroyed. Just ask the Germans in 1937 or the Japanese in 1941. Just look to the example of any famine induced by war. War disrupts logistics, which is a more sophisticated way of saying something that sounds prosaic: War raises the costs of shipping, even going so far as to make shipping prohibitively costly. That is a very bad thing.

So, appreciate your truckers, railroad engineers and pipeline engineers, the people who make logistics work seamlessly. When they do their jobs, no one notices. Oil flows; natural gas flows; homes stay warm in winter; grocery store shelves remain stocked with toilet paper. When these people are prevented from doing their jobs, very bad things happen.

How should we understand the leadership of the United States and of the NATO bloc more generally on this matter of boycotting Russian energy? Should we dismiss it as incompetent, or is it part of “a cunning plan”?

The argument for “cunning plan” might go something to the effect of:

We can exploit the war in Ukraine as a way of promoting the shift away from fossil fuels—oil, coal and natural gas. Insofar as there are supply disruptions and sharp price increases… we can blame all of that on “Putin” and “Russia”.

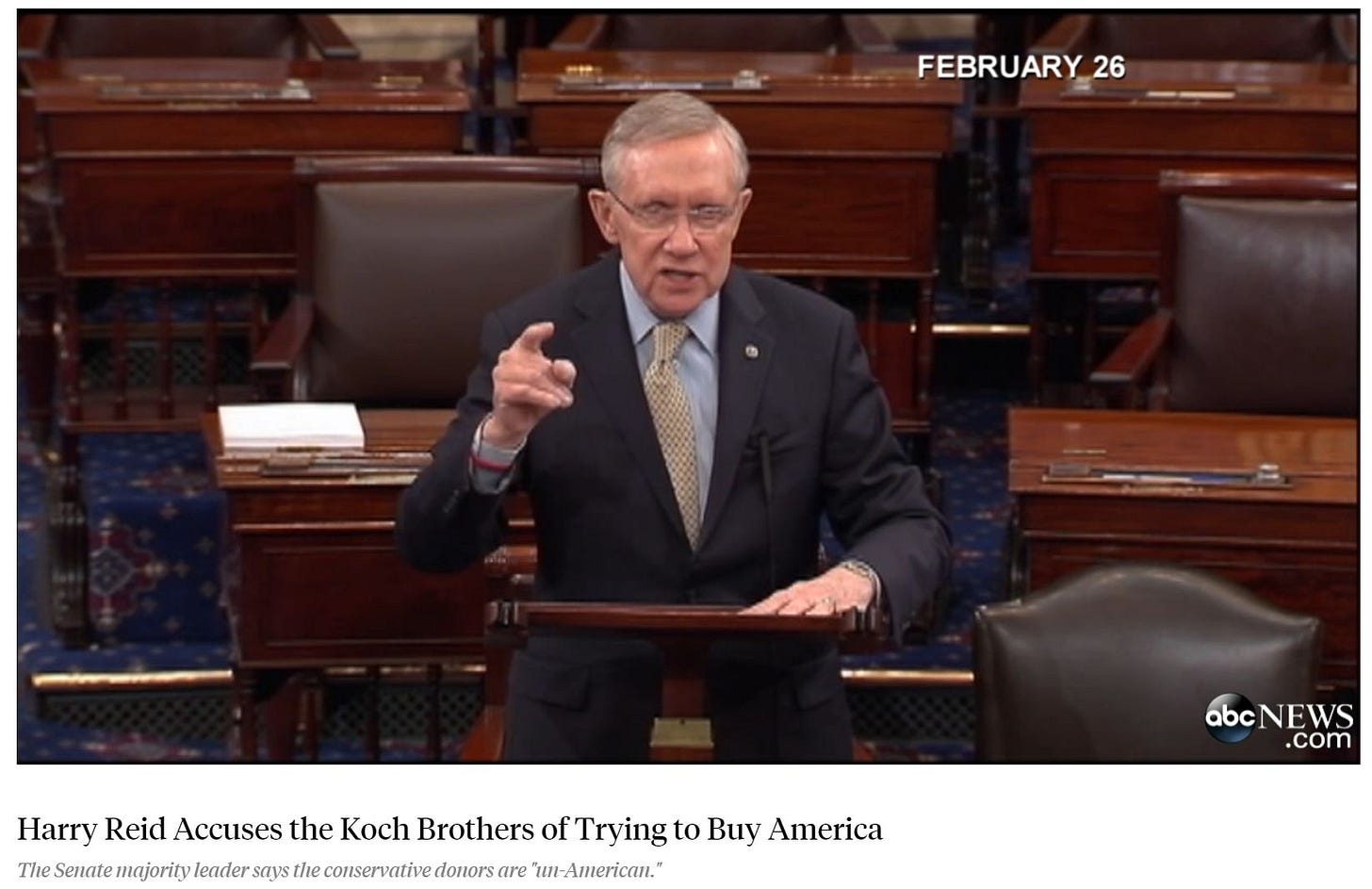

When Harry Reid (D, Nevada) led the Senate, we would blame everything on the “Koch Brothers™,” notwithstanding the fact that the Koch Brothers™ have mostly been on our side. (Among other things, they have always been all-in on open borders.) But, in the run up to the 2016 election, we decamped Koch territory and permanently set up shop in Putin’s richer, greener and lush backyard. It’s been “Russia, Russia, Russia!” ever since.

The rhetoric of “Putin’s Price Hike” will provide us cover for our anti-market, anti-energy policies. Let’s post videos about just that. See, for example, back in March:

Not everyone will buy into the Grand Narrative. That pesky Russell Brand, for example, poses his contrary and entertaining takes on these issues. See, for example, “’Putin’s Price Hike’ BULLSH*T” back in March:

That said, we have the establishment media on our side, and that would include the Wall Street Journal. Bless those people.

Meanwhile, we are making good progress on disrupting regional energy markets for coal and natural gas. The politics of it might get a little tight as the colder months approach. But, now is the time to stick to our anti-fossil fuels agenda and induce everyone to make the transition to … uhm … heat pumps that run on electricity. That electricity will come from solar and wind power… That’s the plan, infeasible as it might appear to the benighted among us.

The benighted may call for us to fire-up mothballed coal-fired or gas-fired generation facilities, and they may pose demands to cut a deal with Putin in order to get the gas flowing at full capacity through the Nordstream I pipeline. But we have to hold firm. We are so close to imposing nuke-free and carbon-free Nirvana.

Speaking of nukes: We may also face demands to not close remaining nuclear facilities. Good for the Germans for sticking to their plan to close down their three remaining nukes. But the Japanese are cracking under the pressure. The Japanese Prime, who himself represents the Fukushima area, has committed to building more nukes. Damn those people!

Good spontaneous stuff. I only hope the cunning planners didn't plan any of this. Because they can't seriously have been thinking of Europe's best interests, however successful the energy transition might eventually be.

I suspect the Russians might be laughing a little at Germany's future plight because Germany never observed any externalities thinking, not sure what. But the green lobby seems to have affected thinking in a lot of places in their rush. Obviously oil is fungible as currency. Gas is not quite that given the extra costs involved.

Oil is subject to demand destruction which seems to be the reason behind the current declines. But China has lowered use simply because of government foolishness that has restrained growth and they have access to needs using dirty coal to power their EVs. The EU will face real issues in the cost of electricity to power their EVs. Might be interesting to examine that relationship as EVs vs power start to interact. The US has some excess capacity that allows EV charging to be not a factor but as EV use grows, so do charging needs and infrastructure isn't always so easy. Still most EVs will be for the rich who live in homes capable of solar power/storage well beyond the masses. The misguided CA policy may be short lived.

This rush to green has revealed we are not even near ready, that Amazon has yet to deliver energy overnight. Technology has been moving along, at a pace of fits and starts as we learn and employ it. Whether central planning can speed it along is unknown but likely it can't.